Over the past few months, the performance of the Leveraged Anchor strategy has exceeded our expectations. There has also been a few things learned regarding adjustments after large market falls, that had never been contemplated (see Anchor Analysis And Options).

The model portfolio also expended a bit of cash to reset the long call position, so the strategy could participate more if and when the market continues to rebound.

Even with this good performance, we are always looking to improve overall performance. Improved performance can occur through a reduction in risk, better absolute performance over time, or a combination of the two.

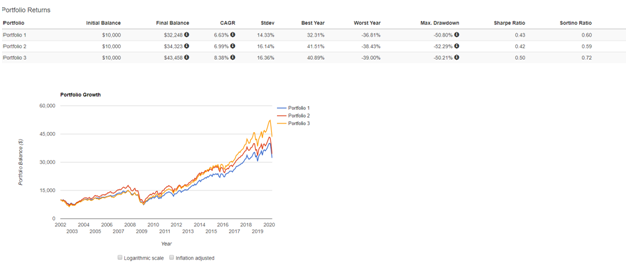

I’ve created three different portfolios for demonstrative purposes. Portfolio 1 is 100% long SPY. Portfolio 2 is 25% each of SPY, IWM (small caps), QQQ (technology), and EFA (international). Portfolio 3 roughly curve fit the best blend of them (thanks to portfolio visualizer):

As can be seen, virtually any blend of diversified assets has outperformed simply holding one asset class over the last 20 years. If we curve fit, we can greatly increase performance – by almost 2% per year. Historically, going further back in time, this pattern holds even more true. A diversified blend of assets typically reduces risk and increases performance, over significant periods of time.

Of course, you’ll be able to find a 1-5 year period (or maybe even longer), where a single asset class outperforms a diversified basket – but good luck picking that asset class moving forward. Is it time for international stocks to rebound more than the U.S. despite lagging for a decade? Are small caps going to outperform large caps as they traditionally do? What about technology – will it continue to outperform other large caps? Maybe you have those answers, but I don’t. However, as a long term investor, I know that diversification works over time.

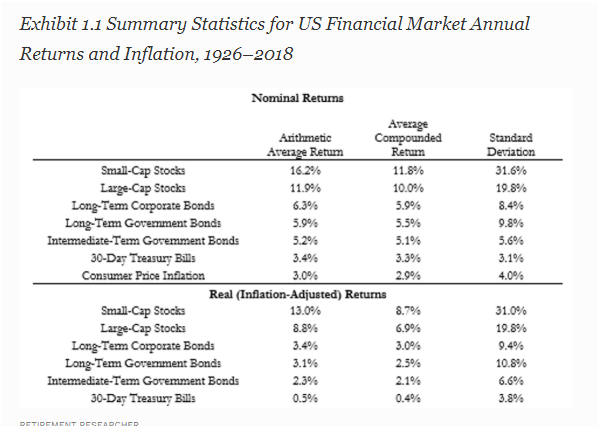

How does one decide what the “optimal” split is in allocation? If you look over the last 20 years, SPY has a CAGR of 5.58%, IWM 6.03%, QQQ 7.08%, and EFA 4.31%. What if we take out the recent bull run in large caps and look at the first decade of this century (2001-2010)? Things change drastically. SPY has a CARG of 3.00%, IWM 6.83%, QQQ 4.24%, and EFA 6.69%. If you expand further, you can find (thanks to Forbes):

(Note: Technology was not an asset class for much of the above period).

After reviewing multiple periods of time (from one year to one hundred years), several trends are clear:

- Small caps typically outperform large caps;

- Over the last 10 years, large caps have been the best performing;

- Technology stocks have outperformed even large caps significantly in the last decade;

- International stocks have consistently under performed large cap, small cap, and technology, but that trend is “recent” in the last 20 years; but

- International has the lowest correlation to the listed classes.

There is no “magic” blend and each investor can create their own. Some people will be most comfortable with a straight 25/25/25/25 split, which takes any risk for picking which sector is going to perform the best off the table. Others will weigh the most recent better performers stronger. If we look at just the last 10 or 20 years, we would not allocate anything to international stocks. However, I personally like the low level of correlation and want at least some exposure internationally. I also expect a reversion to small caps outperforming, particularly in the near future. In my personal portfolio, I would choose:

- SPY 25%

- QQQ 25%

- IWM 30%

- EFA 20%

There is no “correct” blend, as it is impossible to know which class will perform the best moving forward, particularly over long periods of time. Part of the above also contemplates some of the overlap between QQQ and SPY.

Once an asset class division is decided on, all that is left to do is to implement the Leveraged Anchor strategy on each asset. This is the biggest challenge in setting things up, as it is capital intensive. Assuming 3 contracts is the smallest size one can use (3 long calls, 3 long puts 5% out of the money, 1 long put at the money, and one short put), then current minimum amounts necessary to open a Leveraged Anchor strategy:

- SPY: $35,000

- QQQ: $30,000

- IWM: $20,000

- EFA: $7,500

These values are going to somewhat dictate how you divide your money among the different asset classes. For instance, it is virtually impossible, without very large sums of money, to get the splits I set out above. I could get close:

- SPY: $35,000 25.6%

- QQQ: $40,000 29.2%

- IWM: $46,667 34.14%

- EFA: $15,000 10.9%

But to implement the above, I would need almost $140,000. The minimum I would need to implement any version of a diversified Anchor is still over $90,000.

I would advise any client that is interested in Anchor, and who has over $100,000 to invest, that diversifying the strategy, shouldover long periods of time. In any given one- or two-year period, there will be outperformance by one class over the other. The goal of diversification is to reduce variability and risk, while increasing returns, over long periods.

In the near future, we will begin listing out Leveraged Anchor trades for the different asset classes. Members are free to stick with SPY or come up with their own diversification blend. As always, if you would like to open a managed account, and have Lorintine Capital manage a diversified Anchor portfolio for you, we would be happy to discuss the matter.

Christopher Welsh is a licensed investment advisor and president of LorintineCapital, LPCERTIFIED FINANCIAL PLANNER™

What Is SteadyOptions?

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Recent Articles

Articles

Pricing Models and Volatility Problems

Most traders are aware of the volatility-related problem with the best-known option pricing model, Black-Scholes. The assumption under this model is that volatility remains constant over the entire remaining life of the option.

By Michael C. Thomsett, August 16

- Added byMichael C. Thomsett

- August 16

Option Arbitrage Risks

Options traders dealing in arbitrage might not appreciate the forms of risk they face. The typical arbitrage position is found in synthetic long or short stock. In these positions, the combined options act exactly like the underlying. This creates the arbitrage.

By Michael C. Thomsett, August 7

- Added byMichael C. Thomsett

- August 7

Why Haven't You Started Investing Yet?

You are probably aware that investment opportunities are great for building wealth. Whether you opt for stocks and shares, precious metals, forex trading, or something else besides, you could afford yourself financial freedom. But if you haven't dipped your toes into the world of investing yet, we have to ask ourselves why.

By Kim, August 7

- Added byKim

- August 7

Historical Drawdowns for Global Equity Portfolios

Globally diversified equity portfolios typically hold thousands of stocks across dozens of countries. This degree of diversification minimizes the risk of a single company, country, or sector. Because of this diversification, investors should be cautious about confusing temporary declines with permanent loss of capital like with single stocks.

By Jesse, August 6

- Added byJesse

- August 6

Types of Volatility

Are most options traders aware of five different types of volatility? Probably not. Most only deal with two types, historical and implied. All five types (historical, implied, future, forecast and seasonal), deserve some explanation and study.

By Michael C. Thomsett, August 1

- Added byMichael C. Thomsett

- August 1

The Performance Gap Between Large Growth and Small Value Stocks

Academic research suggests there are differences in expected returns among stocks over the long-term. Small companies with low fundamental valuations (Small Cap Value) have higher expected returns than big companies with high valuations (Large Cap Growth).

By Jesse, July 21

- Added byJesse

- July 21

How New Traders Can Use Trade Psychology To Succeed

People have been trying to figure out just what makes humans tick for hundreds of years. In some respects, we’ve come a long way, in others, we’ve barely scratched the surface. Like it or not, many industries take advantage of this knowledge to influence our behaviour and buying patterns.

- Added byKim

- July 21

A Reliable Reversal Signal

Options traders struggle constantly with the quest for reliable

By Michael C. Thomsett, July 20

- Added byMichael C. Thomsett

- July 20

Premium at Risk

Should options traders consider “premium at risk” when entering strategies? Most traders focus on calculated maximum profit or loss and breakeven price levels. But inefficiencies in option behavior, especially when close to expiration, make these basic calculations limited in value, and at times misleading.

By Michael C. Thomsett, July 13

- Added byMichael C. Thomsett

- July 13

Diversified Leveraged Anchor Performance

In our continued efforts to improve the Anchor strategy, in April of this year we began tracking a Diversified Leveraged Anchor strategy, under the theory that, over time, a diversified portfolio performs better than an undiversified portfolio in numerous metrics. Not only does overall performance tend to increase, but volatility and drawdowns tend to decrease: